Anticipated date when the new business location will be open to customers.Include reasons why the business decided to move.A business change of location letter should include the following aspects: Whenever a business moves, they typically want their clients to know about it. The letter needs to be addressed to the name of the client, should notify them of the address change within the first paragraph, and can also include a sentence thanking them for their loyal patronage. These kinds of letters will have a much different tone than ones that are sent to a magazine subscription or financial institution. When we talked to the CRA about not being able to get through on the phone, they said they were planning to hire more agents for this tax season, and contracting a third-party service provider to assist with capacity issues.Individuals who have a personal association with their clientele connected to their work will need to inform all of them of their new address as well. But if you’re one of the 800,000 Canadians who have been locked out of their M圜RA accounts entirely because of the hack last year, you’ll have to find another way.

CANADA REVENUE AGENCY ADDRESS CHANGE UPDATE

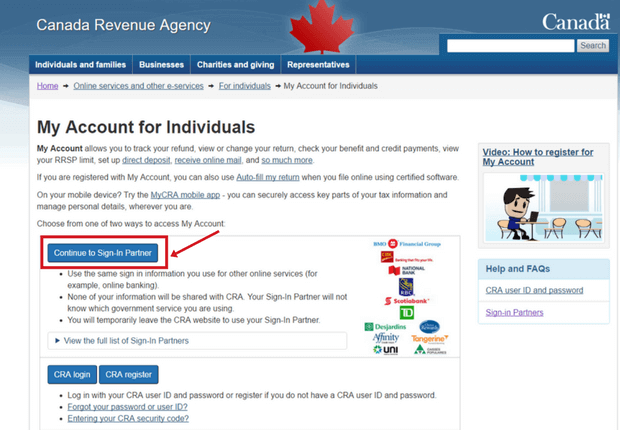

The CRA called me and said, ‘Well, we can update your address on the phone.’ And then a couple of days later I logged back on and suddenly the function was working again.”įor most accounts, the portal re-opened on March 14. “I emailed again and CCed the media the second time I emailed,” he said. He contacted his local government representatives and filed a formal complaint, but that didn’t do it. We tried it, and it took about two weeks to be processed and for the changes to be reflected in our account.įor Anhorn – it took three months for his problem to be solved. So if you can’t change your address online and the phone lines are too busy, how do you do it? Good old-fashioned snail mail.įill out the form available online and mail it in. Among these, the service to change your address, which is temporarily unavailable.” This included blocking some services within the online portals. In an email, a spokesperson said: “As a result of the cyber incidents that occurred in August 2020, the Canada Revenue Agency took swift action to secure taxpayer accounts. We reached out to the CRA to find out why this was happening. “And given what the CRA’s going through, they don’t need more paper than they have to have.” “I would have to paper change them,” he said. He was frustrated, and couldn’t file his taxes online with the address change in place. Please call back later.”Īnhorn tried different times of day, even different days of the week, but couldn’t get through. “Due to high demand, all of our agents are currently busy and our agent queues are full. But when he called, he was stuck in a phone tree for five minutes, and then got this recorded message: On the M圜RA online account, when he clicked “Update my address” he got an error message instructing him to call the agency. “Getting a driver’s licence, the health card for Ontario – all of that went really well, except getting my address updated with CRA.” Smoothly, that is, until he had to update his address. “Not sure I would recommend moving in the pandemic to anyone,” he told McLaughlin On Your Side. When Michael Anhorn took a new job in Toronto last year, he knew a move across the country would be tough. And there have also been some hoops to jump through to make basic updates to your personal information. But there have also been some new wrinkles: paying taxes on the CERB, claiming work from home expenses, maybe even virtual appointments with your accountant.

It’s tax time, and because of the pandemic, there are some extra things you may need to do this year.

0 kommentar(er)

0 kommentar(er)